We all know that kids learn best trough games. And not only kids, we see that “gamification” is added to a lot of websites or apps for adults. Making it look like it is a game make us go a step further. If kids are motivated to go the the next level, or to progress, they will stick to the game or app.

Why it is important for kids to be financially educated?

Our society evolved in a way where we are depending on financial systems and institutions. Most people get into debt as soon as they go to college. It is not a bad thing by default, but the more someone is financially educated, the better decisions can he make in life. These early decisions usually predict the path someone will take in life, so it is most important to make them informed.

What are the things kids need to know about finances?

The first things that someone deals with are credits and deposits. Most kids need a loan to go to college, or more, parents can open a credit card in child’s name. This is also not necessarily a bad thing, but I think kids need to know what this means.

Having a credit card very soon in life will add to his credit score, and making it easier to take further loans: for college, for the first home, first car, etc.

Most parents set up investment accounts for their young ones, so they can kickstart their life, but with the proper financial education, better investment decisions can be made.

Kids need to be aware how investments work, even if they are simple deposits, real estate or stock investments. Although they still need their parents to make investments, they need to know when it is worth investing in a home, or in stocks.

How is financial education approached in schools?

According to the Council for Economic Education, in 2022, fewer than half of the states in US required personal finance classes for high school graduation. So financial education is not considered that important to be learned in all schools in US.

However, like many other things that we should learn in school, at the end we come to the conclusion that the information gathered is not applied in real life. This is happening because schools put too much importance on memorizing things, rather than applying them.

Learning trough games or other type of apps that have implemented gamification is a much better way to gain skills that we will keep throughout life.

Examples of financial games for young kids.

There are many websites and apps where kids can learn or play games related to financial education. Today I will tell you about two games that are easy accessible and designed for kids at a younger age. The principles are simple, but the games are enjoyable and the concepts, which are very important, will stick to their minds.

The first one is Real Estate Tycoon. The goal is to make money by buying and selling houses and buildings. This game will teach the kids that the value of a building is going up or down, and in order to make profitable investments they need to buy when the price is low and sell when the price is high. Finding the right moment to buy or sell is the most important factor.

You have three modes of playing: Careed Mode, Time Trial Mode, and Endless mode.

Career mode gives you missions with a profit target and a time deadline. Time Trial mode gives you a target profit that you will have to reach in a specific time, while Endless mode lets you play as long as you want.

During the game, properties will show up and the price will go up and down. You need to wait for the right moment to buy and sell. You have to act quick, because the price will go up and down very fast. You might be tempted to rush to purchase a property as soon as it appears, but you don’t know if the price will go much higher that it is now. The right way might be to wait for the price to go down, but during this time you have you money locked and you might miss out other good deal.

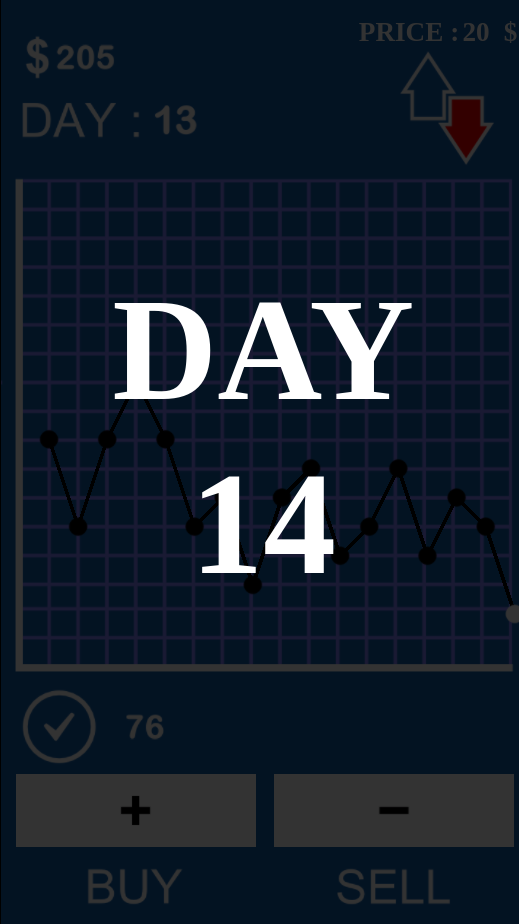

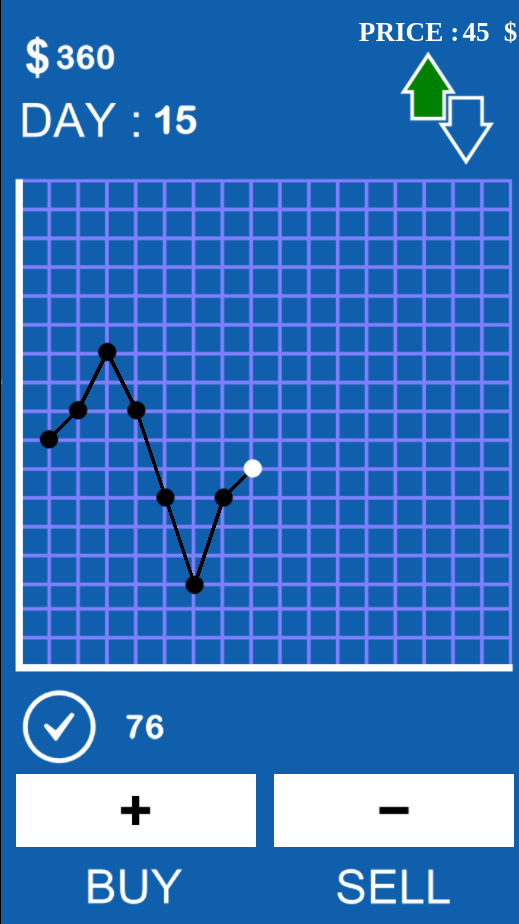

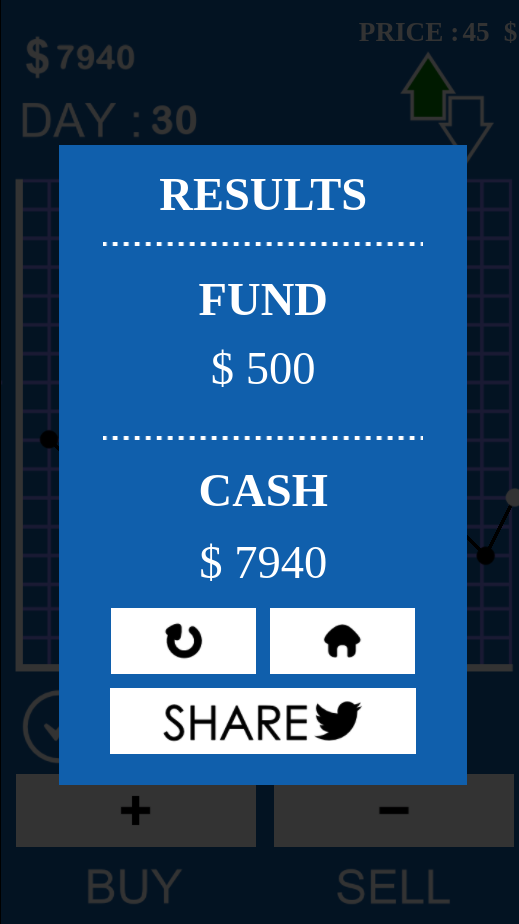

Another great game for leaning about investments is “Stocks“. Yout get an initial fund of $500, and you have 30 days to make the most profit. You can buy and sell shares at different prices. The market is changing very fast so you have to be very fast in your decisions. If you wait too much, you might miss the opportunity. The goals is to sell at a higher price. Volume is also important. If you wait to buy when it is at the lowest point, or to sell when it is at the highest price, you might find it hard to make the volume needed for the maximum revenue.

Kids need to be familiarized with the stock market, because a lot of things are relying on it.

Conclusion

The internet provides our kids infinite ways to learn and play. We have to find the right ones that deserve to “invest” our time into.